Buy Carbon Credit Exchanges

One of the hot commodities on today’s markets is carbon credits. These are permits that allow businesses to pollute a certain amount. Each credit is equal to one metric ton of CO2 emissions, which is a greenhouse gas. As we transition away from fossil fuels and move toward cleaner energy sources, carbon credits will become increasingly valuable.

Many governments have established carbon credit exchange markets to manage and reduce emissions. In these systems, companies are issued a number of carbon permits each year that they can trade with other firms. This system also helps create a price signal that encourages investment in lower-carbon technologies.

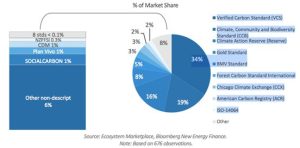

In addition to the regulated market, there’s also a voluntary market for carbon credits. This is open to anyone who wants to participate in the green movement, regardless of whether or not they’re required by law to do so. This market is expected to grow in the future, as more and more people realize the benefits of carbon credit trading.

Why Buy Carbon Credit Exchanges?

Carbon markets are a great way to cut greenhouse gases from the atmosphere. Basically, companies that produce more than their allotted number of carbon credits can sell their excess to other organizations that need more. This allows the fewer-emissions company to help the environment while still making a profit.

However, the underlying technology for these carbon credit exchanges is still developing. One emerging solution is blockchain, which is a distributed ledger technology (DLT) that offers speed, security, and scale. A new carbon credit exchange, called ACX, uses blockchain technology to provide a fully integrated DLT platform for buyers and sellers of carbon credit certificates.

This carbon credit exchange features a number of benefits for traders and brokers. For example, it supports multiple currencies and trading volumes. It also provides users with a unified view of the market and allows them to easily compare prices and options. Additionally, ACX’s infrastructure is designed to handle high volumes of transactions with low latency. This makes it ideal for institutional investors, brokers, and traders looking to gain exposure to the rapidly growing carbon credit market.

The carbon credit exchange also supports a wide range of project types and sizes. Its marketplace includes a variety of verified emission reduction projects (VERs) and a broad selection of certified Emission Reductions (CERs). These include forestry, biogas, hydropower, landfill gas, and waste-to-energy.

In addition to its streamlined user experience, ACX’s marketplace offers an extensive network of project participants. This includes private and public sector entities, as well as NGOs. The platform also has a dedicated support team that’s available around the clock to answer any questions.

Another benefit of this carbon credit exchange is its global reach. Its footprint spans across North America, Europe, and Asia. Buyers and sellers can also choose the type of currency they want to use, as well as their preferred trading method. For example, some people prefer to trade carbon credits using a virtual wallet.